Corporate & Securities

Practical & trusted advice for your business

Our corporate and securities team is flexible, solutions-oriented, and works with you to help your company achieve its business goals and growth objectives.

Our clients include start-ups, family businesses, smaller reporting companies, large private companies with hundreds of shareholders, large public companies, institutional investors, corporate investors, private equity funds, and venture capital funds.

We also work closely with in-house counsel often serving as outside general counsel to public and private companies. Many of our corporate attorneys are former in-house counsel and C-level executives, former compliance officers, and former U.S. government regulators.

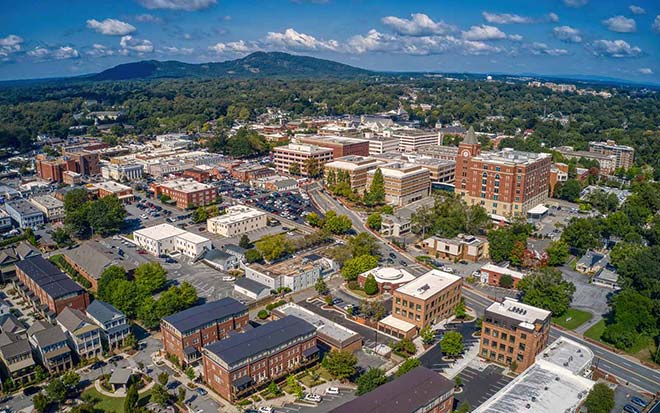

Geographic location and scale for cost-efficient deal execution

Our staffing models, office locations, philosophy, and flexibility in structuring client relationships and fees allow us to create solutions designed to drive business value to our clients.

Our team of 200+ corporate attorneys close more than 150 private equity, venture capital, and angel financing transactions annually and, in recent years, have handled more than 160 mergers and acquisitions with deal values ranging from $10 million to $1 billion. Our experience extends to securities offerings, SEC reports, NASDAQ & NYSE listings and compliance. We work with you on buy and sell-side transactions, carve-outs, private equity buy-outs, roll-ups, and spin-offs, meeting your specific needs in every deal.

M&A for clients across industry sectors

Middle market transactions are different from the deals that make the front page of the Wall Street Journal--our team understands the difference.

We take a practical approach, focusing on what’s important for each transaction with a balance of appropriate senior-level attention and efficient staffing.

Our attorneys have experience across industry sectors, including banking and financial services, FinTech, business services, consumer products, healthcare, hospitality, manufacturing and distribution, media, pharmaceuticals, retail, social media, software, technology, telecommunications, and transportation.

We also have buy-side and sell-side experience. We have long-term private equity and strategic clients who ask to help them make multiple platform and add-on acquisitions, and we help entrepreneurs and families sell their businesses in the transaction of a lifetime.

Broad range of Corporate Services

Business clients we serve include

- Businesses with global operations

- Corporate Investors

- Private equity funds

- Venture capital funds

- Emerging growth companies and start-ups

- Financial Institutions

- Issuers and underwriters

- Middle market companies

- Privately held companies

- Publicly held companies

Advising Emerging and Growth Stage Companies

Consistently ranked as a top east-coast law firm in representing venture-backed companies, our Firm’s Emerging Growth & Venture Capital team works closely with founders, management teams, investors, and board members to help companies scale across various industries

- Legal Fundamentals – we frequently advise companies on entity formation issues, capital-raising strategies and transactions, corporate governance matters, customer and vendor contract negotiations, employment matters, equity compensation strategies, intellectual property issues, securities law compliance, exit planning, and M&A transactions

- Leveraging relationships to Create Opportunities – through our team’s professional networks, deep investor relationships, broad industry contacts, and keen understanding of the strategic drivers of your business, we are able bring to significant opportunities to our clients that help them achieve meaningful growth

- Scale – working side-by-side with clients as they grow, our team draws upon the Firm’s deep bench and diversified practice platform to help our clients achieve scale. We grow with you

Our strengths include

Why Nelson Mullins?

- Business sense, practical approach and flexibility in fee structures and staffing models

- Direct partner-level involvement at competitive rates

- Efficiencies driven by geographic footprint, staffing model, and Firm philosophy

- Experience in executing middle market deals and counseling emerging growth companies

- Industry networks and thought leadership- Southeastern M&A Forum, Nelson Mullins’ Unconference

The Nelson Mullins corporate team has the experience and relationship mindset to help clients manage their business challenges.

Why Nelson Mullins?

- Business sense, practical approach and flexibility in fee structures and staffing models

- Direct partner-level involvement at competitive rates

- Efficiencies driven by geographic footprint, staffing model, and Firm philosophy

- Experience in executing middle market deals and counseling emerging growth companies

- Industry networks and thought leadership- Southeastern M&A Forum, Nelson Mullins’ Unconference

The Nelson Mullins corporate team has the experience and relationship mindset to help clients manage their business challenges.

- Antitrust

- Blockchain & Digital Currency

- Broker Dealers & Investment Management Litigation

- Business Development Companies

- Corporate Governance

- Corporate Leveraged Finance

- Cybersecurity & Data Privacy

- E-Discovery - Encompass

- E-Discovery & Information Governance

- Emerging Companies

- Executive Compensation, ERISA, Employee Benefits

- FinTech

- Franchise & Distribution - Corporate

- General Counsel Services

- Investment Management

- Litigation

- Mergers & Acquisitions

- Private Equity

- Public Company Compliance & Counseling

- Securities & Enforcement

- Securities and Corporate Governance

- Securities Offerings

- Tax

- White Collar Defense & Government Investigations

Why Nelson Mullins?

- Business sense, practical approach and flexibility in fee structures and staffing models

- Direct partner-level involvement at competitive rates

- Efficiencies driven by geographic footprint, staffing model, and Firm philosophy

- Experience in executing middle market deals and counseling emerging growth companies

- Industry networks and thought leadership- Southeastern M&A Forum, Nelson Mullins’ Unconference

The Nelson Mullins corporate team has the experience and relationship mindset to help clients manage their business challenges.

Why Nelson Mullins?

- Business sense, practical approach and flexibility in fee structures and staffing models

- Direct partner-level involvement at competitive rates

- Efficiencies driven by geographic footprint, staffing model, and Firm philosophy

- Experience in executing middle market deals and counseling emerging growth companies

- Industry networks and thought leadership- Southeastern M&A Forum, Nelson Mullins’ Unconference

The Nelson Mullins corporate team has the experience and relationship mindset to help clients manage their business challenges.

Geographic location and scale for cost-efficient deal execution

Our staffing models, office locations, philosophy, and flexibility in structuring client relationships and fees allow us to create solutions designed to drive business value to our clients.

Our team of 200+ corporate attorneys close more than 150 private equity, venture capital, and angel financing transactions annually and, in recent years, have handled more than 160 mergers and acquisitions with deal values ranging from $10 million to $1 billion. Our experience extends to securities offerings, SEC reports, NASDAQ & NYSE listings and compliance. We work with you on buy and sell-side transactions, carve-outs, private equity buy-outs, roll-ups, and spin-offs, meeting your specific needs in every deal.

M&A for clients across industry sectors

Middle market transactions are different from the deals that make the front page of the Wall Street Journal--our team understands the difference.

We take a practical approach, focusing on what’s important for each transaction with a balance of appropriate senior-level attention and efficient staffing.

Our attorneys have experience across industry sectors, including banking and financial services, FinTech, business services, consumer products, healthcare, hospitality, manufacturing and distribution, media, pharmaceuticals, retail, social media, software, technology, telecommunications, and transportation.

We also have buy-side and sell-side experience. We have long-term private equity and strategic clients who ask to help them make multiple platform and add-on acquisitions, and we help entrepreneurs and families sell their businesses in the transaction of a lifetime.

Broad range of Corporate Services

Business clients we serve include

- Businesses with global operations

- Corporate Investors

- Private equity funds

- Venture capital funds

- Emerging growth companies and start-ups

- Financial Institutions

- Issuers and underwriters

- Middle market companies

- Privately held companies

- Publicly held companies

Advising Emerging and Growth Stage Companies

Consistently ranked as a top east-coast law firm in representing venture-backed companies, our Firm’s Emerging Growth & Venture Capital team works closely with founders, management teams, investors, and board members to help companies scale across various industries

- Legal Fundamentals – we frequently advise companies on entity formation issues, capital-raising strategies and transactions, corporate governance matters, customer and vendor contract negotiations, employment matters, equity compensation strategies, intellectual property issues, securities law compliance, exit planning, and M&A transactions

- Leveraging relationships to Create Opportunities – through our team’s professional networks, deep investor relationships, broad industry contacts, and keen understanding of the strategic drivers of your business, we are able bring to significant opportunities to our clients that help them achieve meaningful growth

- Scale – working side-by-side with clients as they grow, our team draws upon the Firm’s deep bench and diversified practice platform to help our clients achieve scale. We grow with you

- Business sense, practical approach and flexibility in fee structures and staffing models

- Direct partner-level involvement at competitive rates

- Efficiencies driven by geographic footprint, staffing model, and Firm philosophy

- Experience in executing middle market deals and counseling emerging growth companies

- Industry networks and thought leadership- Southeastern M&A Forum, Nelson Mullins’ Unconference

The Nelson Mullins corporate team has the experience and relationship mindset to help clients manage their business challenges.

Highlights from Insights